Introduction

Buy Now Pay Later (BNPL) has culturally shifted the consumer market. It lets you own something in just a few seconds. However, is it really the case, or is there more complexity to the concept of BNPL? Let’s learn more about BNPL and whether it’s really the end of the true essence of ownership.

About Buy Now Pay Later

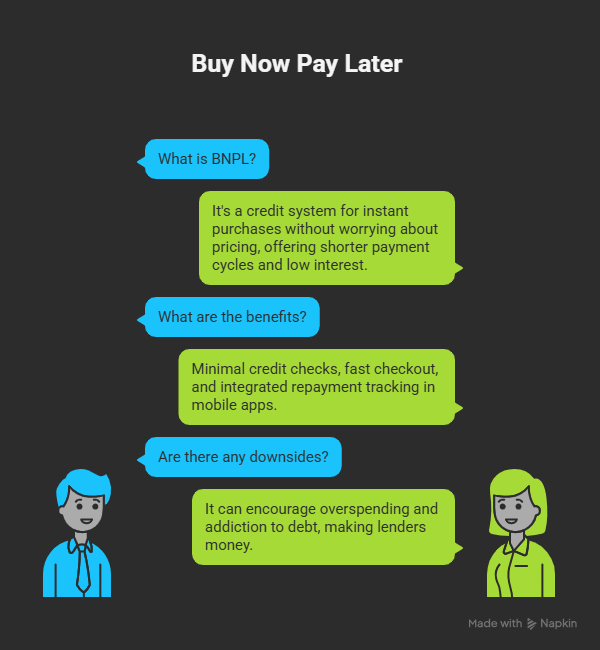

BNPL is a credit system that lets you buy something instantly without worrying about pricing. Compared to traditional credit systems, BNPL offers shorter payment cycles and, in some cases, little to no interest. In most cases, there are minimal credit checks and fast checkout integration. All this is integrated into the mobile application for repayment tracking. So, you don’t have to worry about your banks.

All this seems cool. However, there is an ulterior motive in the seamless atmosphere of Buy Now Pay Later. It is to get into the habit of overspending and over-purchasing. Once you’re addicted to this way of life, you’re never out of debt. That’s what makes lenders money in BNPL scenarios.

How BNPL Shifts Your Consumer Mindset

With credit options like BNPL, you, as a consumer, are less committed to your budget. The instant gratification of purchasing a product detaches the value of earning it with saved money. Moreover, the entire process is very easy and can lead to poor financial awareness. In this way, within a few years, you’re in debt, and there’s no way back.

The Reality of Ownership in the 21st Century

Today, you can buy a lot of stuff. In fact, there are more brands on the market today than in all of human history. Ownership means purchasing items for long-term use and having the products serve their purpose.

Right now, a little bit more of an intentional regulatory approach will meaningfully improve the welfare of [Buy Now, Pay Later] users— Ed deHaan (Professor of accounting at Stanford Graduate School of Business).

But today, you can rent the same product for a mere fraction of its full price. This makes it easier for everyone to have the product. However, in reality, no one has the product in its entirety.

Buy Now Pay Later Normalises Micro Debt

In the past, you took out debt for big purchases like houses or cars. But with BNPL, you get in the habit of taking microloans for even the smallest purchases. This means every facet of your life depends on credit, and it can lead to dark times.

- Debt fragmentation effect.

- Multiple payment stacking.

- Budget illusion creation.

- Reduced spending friction.

- Overextension risk.

Over time, multiple payments can affect your budget, and it all becomes an illusion. In reality, not only do you own the items you bought, but you’re also in debt. This is the worst-case scenario for anyone who hopes to retire or settle fruitfully.

Brands Want You To Pay Later For Products

The big corporations want you to spend more money so that they can meet their targets. An increase in transactions helps payments companies earn as well. Also, BNPL creates a culture where people have no patience and want accessibility to premium products within a few seconds.

Again, you share all your information with the brands, which can further trigger data-driven marketing. Therefore, it is a hedonistic cycle of endless pursuit of happiness through products that you don’t even want in your life.

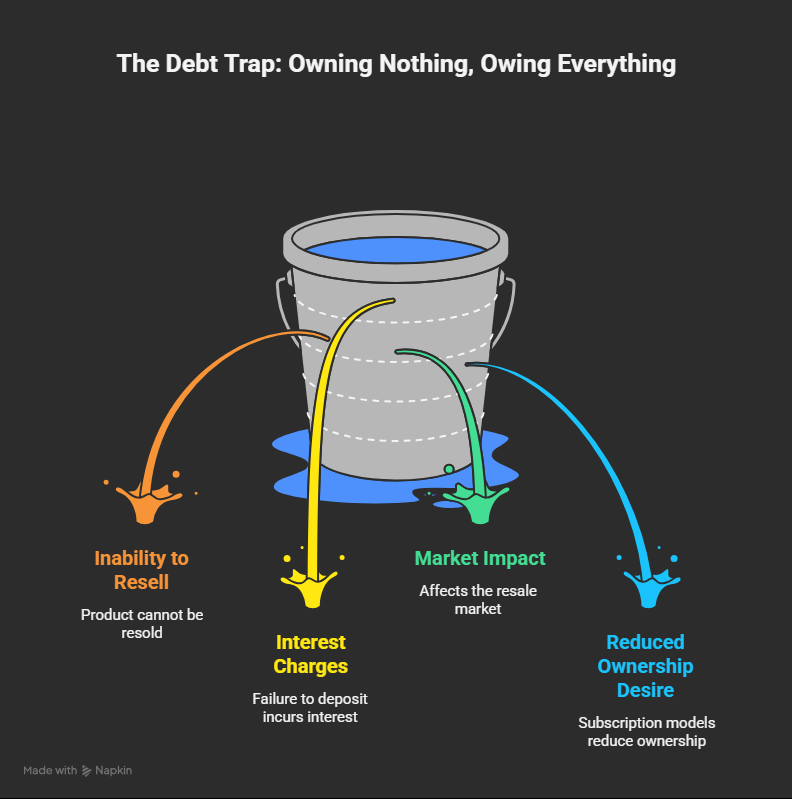

BNPL Reduce Your Desire To Save Or Own

When you pay for a product fully, you own it. But with credit purchasing, you go into debt. This results in two things: you can’t resell the product, and failure to deposit results in interest charges. It also affects the resale market, which is a key way the economy functions.

The rise of subscription models also reduces your desire to own stuff, which is not sustainable from a savings perspective. So, in a way, you own nothing while the things around you own your whole existence.

Financial Risks of BNPL

Buy Now Pay Later is a convenient way to navigate the modern economy as a consumer. But this doesn’t make the whole process ideal for everybody. The repercussions of BNPL are listed below.

- Missed payment penalties.

- Credit score impact.

- Budget miscalculations.

- Emotional overspending.

- Long-term debt habits.

The Future of BNPL

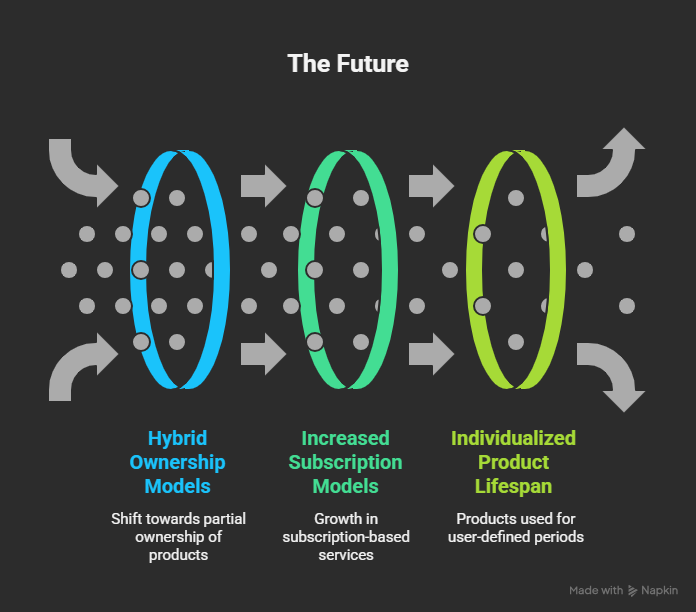

Buy Now Pay Later will redefine the stance of ownership in the modern world. This could lead to hybrid models where you are a partial owner of a product. Moreover, it will also increase the subscription models in the online sphere. As a result, the products will last for a period determined by the individual rather than their lifespan. However, as usual, the future is uncertain, and even a small policy change can alter BNPL’s trajectory.

Final Thoughts on Buy Now Pay Later

Buy Now Pay Later (BNPL) represents a significant shift in consumer behaviour, enabling instant ownership of products without the immediate financial worries. This system often promotes overspending and poor financial awareness, leading consumers into cycles of debt rather than fostering true ownership.

With micro debts for even minor purchases, individuals may find themselves trapped in a cycle of obligations that undermines their budgeting and savings efforts. Moreover, BNPL normalises ownership detached from the actual purchase, encouraging reliance on credit and subscription models and further diminishing the desire to own products outright.

Despite its convenience, BNPL entails serious financial risks, including penalties for missed payments, credit score impact, and the formation of long-term debt habits.